Nvidia’s $4 Trillion Triumph: How One AI Giant Beat Apple and Microsoft at Their Own Game

Nvidia just made history with a $4 trillion market cap, fueled by AI dominance, sky-high demand, and a stock surge that’s turning Wall Street green.

The AI boom just crowned a new heavyweight champion. Nvidia has officially soared past Apple and Microsoft to become the world’s most valuable public company — hitting an astonishing $4 trillion market cap (even if only briefly). Just two years ago, this AI chipmaker was sitting at a comparatively modest $500 billion. Now? It’s rewriting the tech history books.

This leap isn’t just a blip. On Wednesday, Nvidia stock reached an intraday high of $164.42, pushing its market value to the record-breaking $4 trillion mark. While it has since cooled slightly to $3.97 trillion, the moment marks a massive milestone for the entire U.S. tech sector.

From Silicon to Supernova

To understand how Nvidia pulled this off, you only need to look at its role in the AI revolution. This isn’t a company just riding the AI wave; it’s at the forefront of it, powering it. With a dominant 70% to 95% market share in AI chips, Nvidia is supplying the brains behind next-gen tech across Silicon Valley. Meta, Microsoft, and Amazon are just a few of the deep-pocketed players funneling billions into Nvidia’s processors.

These chips are the backbone of everything from generative AI tools to cutting-edge data centers. And the numbers speak volumes: Nvidia’s latest quarterly revenue came in at $44.1 billion, up a jaw-dropping 69% year-over-year. Next quarter? The company expects a cool $45 billion.

A Meteoric Rise in Just 24 Months

If this feels fast, that’s because it is. Here’s a quick recap of Nvidia’s rocket-like growth:

- June 2023: Reached $1 trillion

- February 2024: Crossed $2 trillion

- June 2024: Hit $3 trillion

- June 2025: Briefly topped $4 trillion

In just five years, Nvidia’s stock has exploded more than 1,450%. Year-to-date? Up over 21%. That’s more than just strong. It’s outright historic.

Tech analyst Dan Ives called the $4 trillion surge a “huge historical moment” and dubbed Nvidia the foundation of the AI Revolution. Nvidia is no longer a chipmaker. It’s a symbol of where the entire tech world is headed.

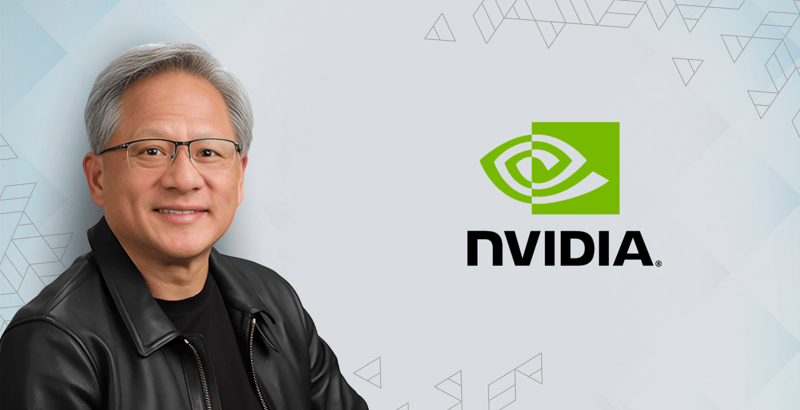

Jensen Huang: The Billion-Dollar Brain Behind the Boom

At the helm of this transformation is CEO Jensen Huang, who’s set to make nearly $1 billion this year from stock sales alone. Under his leadership, Nvidia has expanded not just globally but also stateside, with new plans to build AI chips and supercomputers in the U.S. for the first time.

Huang captured the moment best:

“Countries around the world are recognizing AI as essential infrastructure — just like electricity and the internet — and Nvidia stands at the center of this profound transformation.”

The Bottom Line? Nvidia Isn’t Slowing Down

Nvidia is no longer just a chip company. It’s the backbone of the AI era, the engine of a trillion-dollar transformation, and the current king of the stock market.

Whether you’re an investor, a techie, or just trying to keep up with the news, one thing is crystal clear: Nvidia is the name to watch — and possibly the name to beat — in this AI-driven future.